RED meat producers have endured rough times with the smooth this year. While spikes in lamb prices have seen rates reach historic highs of up to $10/kg for producers, beef prices haven’t enjoyed the same rise as the market buckled thanks to drought‑induced sell offs.

And while the lamb producers lucky enough to have scored top prices over winter have seen big boosts to their bottom lines, other drought-affected properties are facing a day-to-day struggle to keep their breeding numbers.

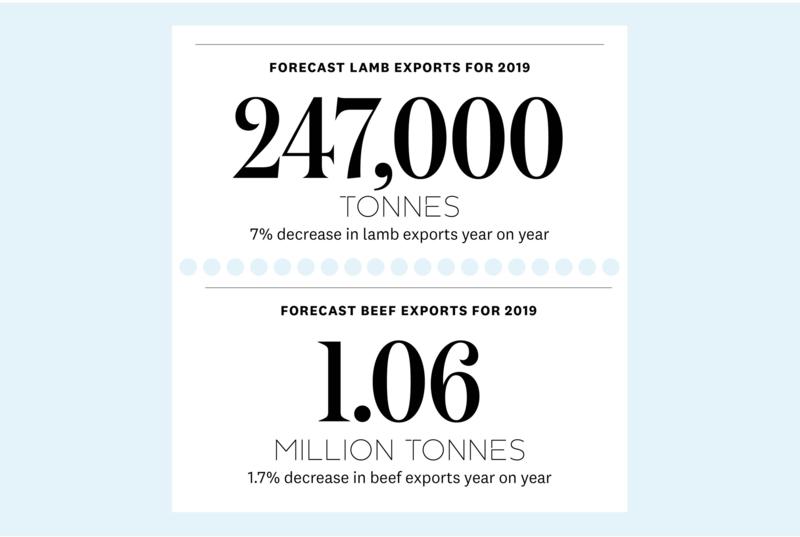

With China and the United States underpinning robust demand for sheepmeat, lamb prices are the overwhelming positive for livestock producers in 2019. Meat & Livestock Australia (MLA) predicts lamb production will be 475,000 tonnes, with 247,000 tonnes or 52% exported. That’s a decline of 7% on 2018 exports, but only due to a lack of supply.

RELATED: Alternative beef labelling opens up export markets

Export markets create profitable returns for lamb producers

Floyd Legge, chair of NSW Farmers’ Sheepmeats Committee, says lamb prices through winter were “unprecedented especially for big lambs”. And while there are reports lamb cutlets could rise to $70/kg in top-end butcher shops, it is the export market that is driving demand. “It is an export influence factor rather than a domestic one,” Floyd says.

The Legges run a Poll Dorset stud flock and a commercial flock turning off prime lambs at two properties at Cudal and Forbes, and have watched the rise and rise of lamb prices carefully.

Floyd Legge with some of his Poll Dorset flock at his property in the Central Tablelands. Photography by Pip Farquharson.

With the national flock at a historic low of less than 66 million head, Floyd can’t see much changing with supplies not expected to lift dramatically. What could influence the prices are global factors, largely outside the control of either lamb producers or meat exporters.

RELATED: Where is the live sheep export trade headed?

“The exchange rate can clearly affect how expensive our lamb is on the world market, and then trade changes like Brexit or the China-US trade war could also impact lamb demand,” Floyd says.

If these trade factors can stay in Australia’s favour, Floyd sees good times ahead for lamb producers. “We have a growing middle class in India and China, who are moving away from low-value cuts to higher end cuts of lamb,” he says. “Australian lamb has developed a diverse range of markets and that’s why I can’t see the high prices disappearing soon.”

Floyd says a major processor told him each lamb could be cut up and sent to 35 different countries, with each of those countries a ready market for each part of the carcase, offal and skin.

Back in Australia the domestic lamb market remains strong, although there is a continuing gradual shift of more lamb being sold to export markets than to domestic customers.

A decade ago, more than 50% of Australia’s lamb production went to the domestic market. Today, it has shrunk to 48%. That means lamb is now eaten in smaller portions or on special occasions, Floyd says.

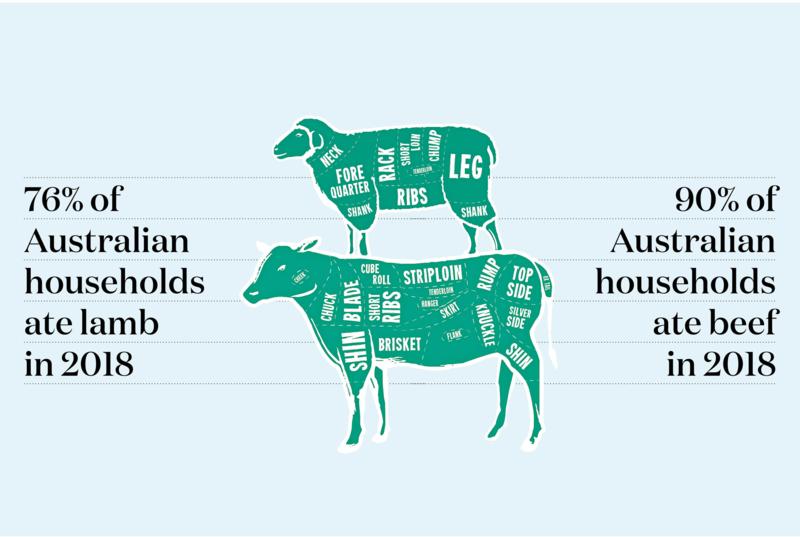

Comparison by percentages of Australian household lamb and beef consumption in 2018.

Comparison by percentages of Australian household lamb and beef consumption in 2018.

“Lamb is not the cheapest form of protein, so when people feed their family, they are buying lamb less often,” he says. “But we know when people eat lamb, they appreciate it more and that in turn pushes back on us as producers because we always want that quality to be there – especially if consumers don’t eat it often.”

MLA domestic market manager Graeme Yardy says both lamb and beef remain in high demand domestically. “Consumer data shows the percentage of households that eat beef and lamb remains very high,” he says. “Beef was on the menu in over 90% of households last year, while the figure for lamb is 76%.

Lambs at a property in Eugowra, Central West NSW. Photography by Pip Farquharson.

Lambs at a property in Eugowra, Central West NSW. Photography by Pip Farquharson.

“While price is a large driver for consumers and an ongoing challenge, MLA has a number of strategies, driven by consumer data to ensure we promote the qualities and attributes of beef and lamb to the right consumers and continue to have them as staples on dinner plates.”

RELATED ARTICLES:

Beef farmers create fresh market for bone broth

The future of Australia’s food waste economy

International demand for Australian red meat remains high despite drought

Internationally, MLA is also working to maintain demand for beef and lamb. General manager of international markets Michael Finucan says boxed meat export value passed $4 billion for the year to April, the first time this had ever happened, after a 26% jump compared to the same period a year earlier.

“The large increase has been driven by drought-induced stock turn off, combined with strong demand from many key export markets, and a dropping Australian dollar which has assisted the competitiveness of Australian exports,” he says, stressing that it is important to maintain international demand.

RELATED ARTICLES:

The young farming family building resilience to drought

Can mainstream media affect market prospects?

“We are conscious that the global trading environment inevitably has a number of challenges. Australia exports red meat and livestock to more than 100 countries – meaning we have a strong and diverse set of markets and customers.

“The notion of a safe product is extremely important and our reputation that is underpinned by strong integrity and

traceability systems is vital for the future success of our product globally.”

Despite the stellar start to the year, MLA is forecasting a decline in red meat exports for 2019, largely due to the drought decreasing available numbers.For many of the NSW cattle producers facing depleted feed supplies and hand feeding, talk of strong demand is of some comfort.

The total forecasted lamb and beef exports for 2019. Source: Source: ABRES, Sheep Central, Meat & Livestock Australia.

The total forecasted lamb and beef exports for 2019. Source: Source: ABRES, Sheep Central, Meat & Livestock Australia.

NSW Farmers’ Cattle Committee member Bill Stacy says demand, particularly from China and the United States, has kept prices solid despite a surge of numbers onto the market.

“The beef prices we have seen are nothing like the lamb industry, but the strong export demand and a drop in the Australian dollar has at least allowed prices to remain steady,” he says.

Bill sees better prices ahead, when good seasons allow producers to rebuild their herds. “There has been a significant depletion in the national breeding herd. In the past few months, 58% of the national processing has been female,” he says.

“That is going to impact on herd numbers down the track and it will take years to rebuild our national herd. “It means that when seasons do improve, processors may have to pay more to secure what they need.”

Rebuilding Australian cattle herd numbers critical for market prosperity

The drought across much of eastern Australia has taken its toll on sheep and cattle numbers, with a rebuilding phase expected to influence prices.

MLA market intelligence manager Scott Tolmie says a return to more average seasonal conditions could see cattle herd rebuilding commence later this year, but dry conditions would restrain any pace.

The Mawhood brothers from Oberon ensure a consistent supply of beef, to their family owned Supa IGA, using smart herd management. Photography by Pip Farquharson.

The Mawhood brothers from Oberon ensure a consistent supply of beef, to their family owned Supa IGA, using smart herd management. Photography by Pip Farquharson.

“Looking ahead, the significant depletion of the herd will result in lower processing rates and fierce rebuilding competition once there is a widespread break in the weather,” he says.

“Even if there is a consistent string of reasonable seasons, it is expected to take a number of years before the national herd is back to its longer-term average of 28 million head.”

On the sheep front, supply is expected to decline next year as producers rebuild, and the flock is expected to recover numbers from 2020-2023.

“Lamb production and processing are also expected to recover from 2020, but the forecast fall in sheepmeat production in 2019 should keep lamb and mutton prices historically high throughout the year with additional upside if improved seasonal conditions spark restocker activity,” Scott says.

The prices forecasted for lamb and beef in 2019/2020. Source: ABRES, Sheep Central, Meat & Livestock Australia.

The prices forecasted for lamb and beef in 2019/2020. Source: ABRES, Sheep Central, Meat & Livestock Australia.

No threat from vegans and vegetarians on red meat consumption

While vegetarianism may seem to be on the rise with vegan restaurants popping up in cities and a variety of meat alternatives on supermarket shelves, MLA consumer research shows there isn’t a huge groundswell of people turning away from red meat.

MLA domestic market manager Graeme Yardy says meat alternatives have been around for several decades.“For the past three years, metropolitan people who identify as vegan or vegetarian have remained stable at 7%,” he says. “At the same time, 15% of meat eaters have been vegetarian in the past, so there is a high return to eating meat.

“This is reiterated by other data which shows plant-based meat products only made up a very small share of fresh-protein sales in the past 12 months, at less than 0.5%.”

There’s certainly been more publicity around fake meat, but Graeme says this is largely due to the increased rate of investment in production methods. “Most experts predict plant-based, cell-based and animal proteins will all co-exist as each offers differentiated attributes and benefits,” he says.

“

Laboratory-based or in-vitro meat is a cultured product made from cellular material. Cellular agriculture is not just making headlines for the novelty factor, and has the potential to be another competitor for red meat, so MLA is keeping a close eye on its evolution.”

North Coast cattle farmers Greg and Lauren Newell from Linga Longa Beef have had to innovate to keep up with changing markets. They are taking on the bone broth health trend to successfully market their high quality grass-fed product to health conscious consumers.

North Coast cattle farmers Greg and Lauren Newell from Linga Longa Beef have had to innovate to keep up with changing markets. They are taking on the bone broth health trend to successfully market their high quality grass-fed product to health conscious consumers.

Aiding the argument for beef and lamb is the consumer trend towards health and wellbeing, Graeme says. “There is a growing preference for natural quality foods from trusted sources, with a strong consumer interest in provenance and production,” he says.

“Naturally and minimally processed Australian beef and lamb will be able to claim a natural or minimally processed label, which is in stark contrast to lab meat which will struggle to make the same claims.”

RELATED ARTICLES:

Sustainable Merino farm turns to perennial grasses

Reaping the rewards of biodynamic farming

Farmers passionate about soil conservation

Creating a nature covenant raises brand value

Cost also comes into the equation at the moment. The first lab-grown burger cost more than $400,000 to produce in 2013, but now companies are claiming they can produce lab-grown meat for less than $12/kg, and costs are tipped to keep falling with private investment and increased demand.